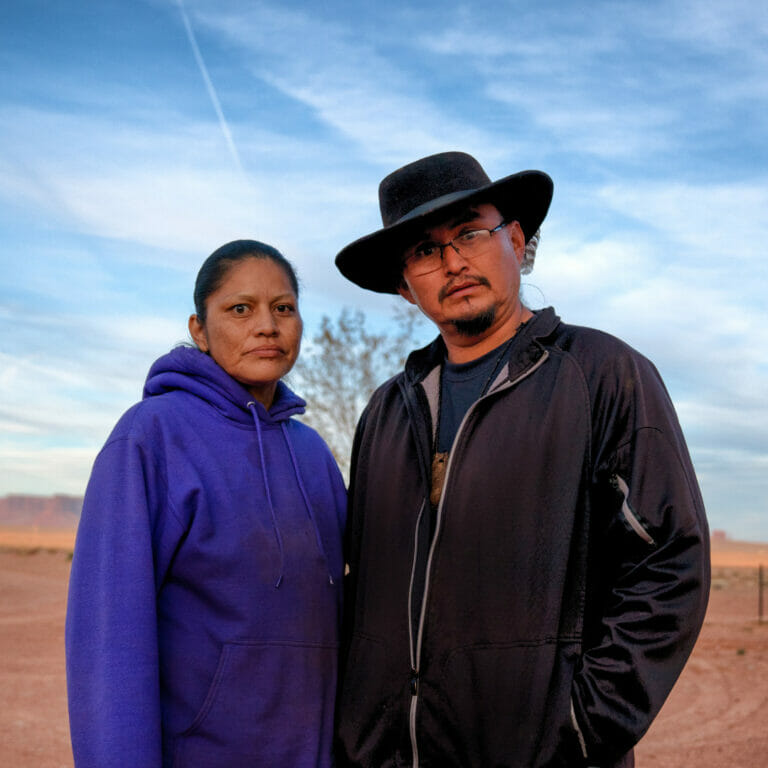

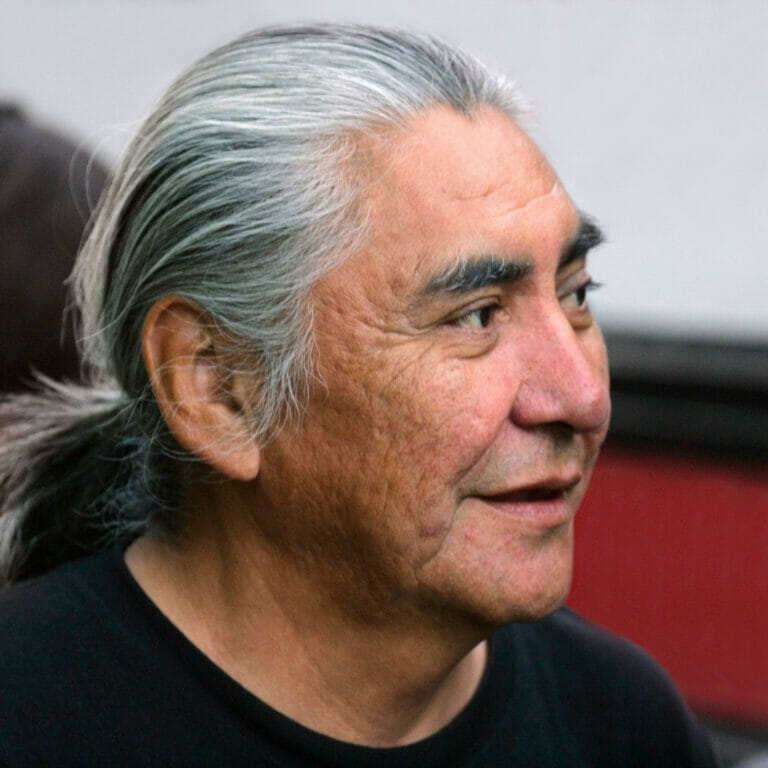

Celebrate Native American Heritage Month with AFCPE!

At AFCPE, we embrace Native American Heritage Month as an opportunity to celebrate and recognize the work of Native American AFC® (Accredited Financial Counselor®) professionals, AFC® Candidates, and AFCPE Members who are making an impact in the field of financial counseling, coaching, and education.

It is also an ideal time for us, as financial professionals, to expand our knowledge about the unique barriers to financial well-being that Native Americans may encounter and ensure that we are using a lens of inclusion in our work.

Native Americans Have Unique Barriers to Financial Capability

Did you know:

- Native Americans are the least likely of all population groups to plan for retirement, have an emergency fund, or have a checking account. [FINRA]

- 16.3 percent of Native households are unbanked. [FDIC]

- Nearly half of people who live in majority-Native communities have subprime credit (46.4 percent), 2.5 times higher than majority-white communities. [Urban Institute]

How You can Support the Native American Community during Native American Heritage Month and Beyond

With the help of AFCPE staff, Members, and certified professionals, we have compiled a list of resources that can be used to guide and support you in your work with Native Americans. This list is not comprehensive, but it can serve as a starting place in your journey to creating an environment that is safe and supportive for your Native American colleagues and clients.

Have more resources to add? Drop them in the comments below!

Recognizing Financial Challenges

Although issues vary across tribes, many Native Americans experience low financial literacy and high financial fragility. There are significant barriers to building wealth and often limited access to important financial services.

Addressing Barriers to Accessing Financial Services

Around 16.3% of Native Americans are unbanked. The reasons for this vary, but include, racism, lack of internet on reservations, and distance from ATMs and banks. Native Americans on reservations are also more likely to be issued a higher interest rate on their mortgages.

- Native Households Have Highest Unbanked Percentage [National Indian Council on Aging, Inc.]

- Overcoming banking hurdles for Native American customers [Independent Banker]

- From the Center for Indian Country Development: New study shows Native Americans face higher-priced mortgage rates [Federal Reserve Bank of Minneapolis]

- Section 184 Indian Home Loan Guarantee Program [U.S. Department of Housing and Urban Development]

Building an Equitable Business

If you’re working to create a more equitable private practice or business, it’s critical that you have the right tools and strategies for both recruitment and retention.

Connect them to qualified, caring AFC® professionals

If you aren’t currently offering one-on-one financial counseling, please help refer clients to:

- AFCPE’s free financial counseling and coaching services, made possible with the support of AFC and FFC® certified volunteers and with generous grant funding from Wells Fargo Foundation.

- AFCPE’s Find an AFC directory: A useful tool to help individuals find a qualified counselor in their area. Rates are determined by individual counselors.

Leave a Reply