Upcoming Events

Upcoming Events

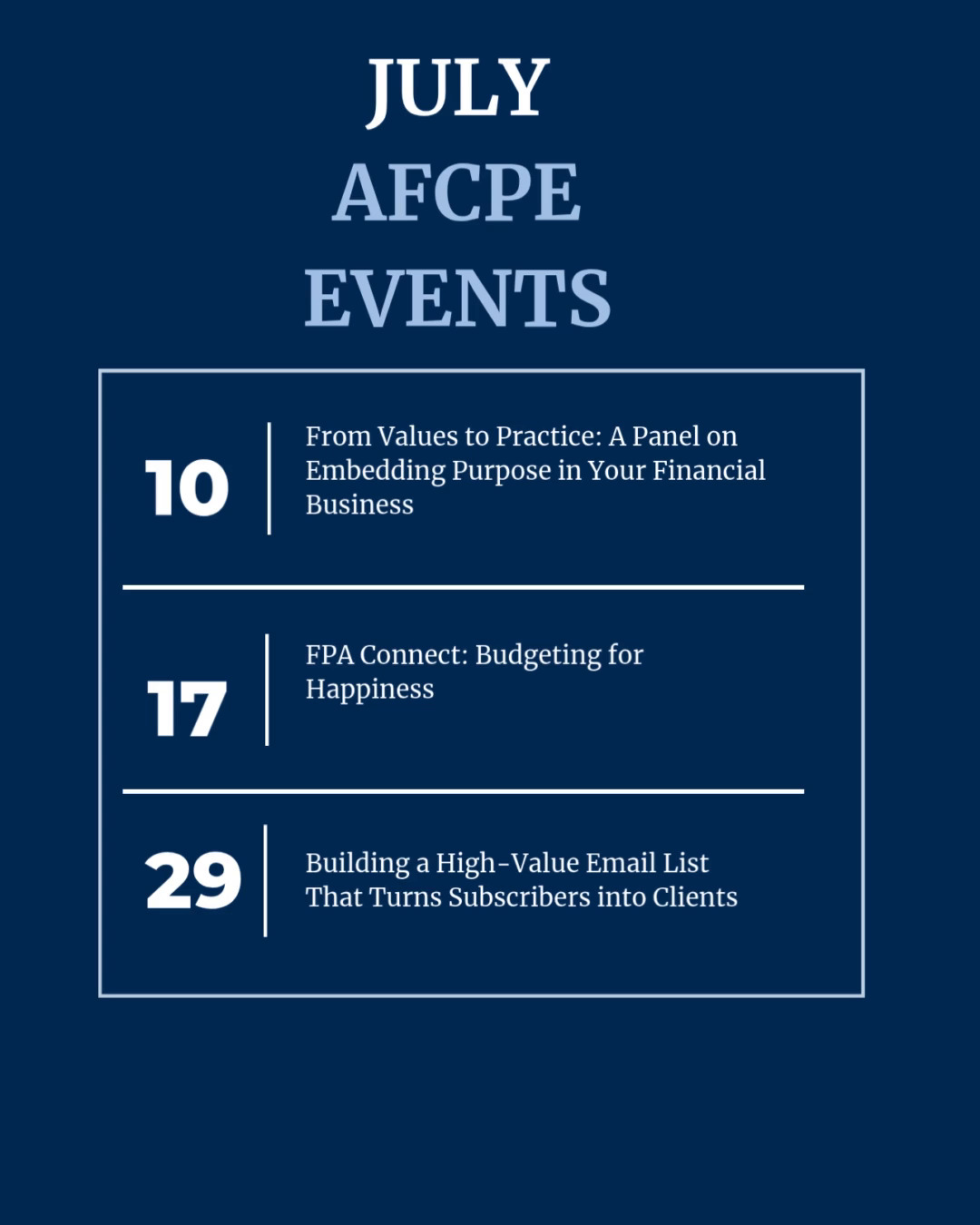

July 2025

Join us for a dynamic panel discussion featuring four trailblazing women—financial advisors and money coaches—who are helping shape the future of values-aligned investing. These leaders will explore the rising interest in purpose-driven investing, particularly among women and younger clients. We'll dive into how each panelist integrates values-based approaches into their…

Find Out MoreThis webinar equips financial counselors and military family service providers with the essential knowledge and skills to recognize the critical link between financial distress and suicide risk among Service members and their families. Identify stress-reducing financial supports, and how to foster long-term resilience through financial literacy and planning. Learners will…

Find Out MoreThis session introduces a therapeutic-informed framework for understanding money dysmorphia—when clients experience a mismatch between their financial facts and internal sense of financial sufficiency. Money dysmorphia is not caused by financial instability, but by distorted self-perception rooted in comparison, fear, and ‘internalized scarcity’. Drawing on financial counseling and therapeutic tools,…

Find Out MoreAs interest rates skyrocket and the consumer debt crisis deepens, financial advisors and coaches must be prepared to guide clients through debt challenges. In follow-up to June’s webinar on identifying the right debt solutions for your clients, this session dives deep into the Debt Management Plan (DMP). In this webinar,…

Find Out MoreIn-person training Dear Community Partner, You're invited to the "Say NO to Scams: Protecting consumers and communities from fraud" training, hosted by Consumer Action and sponsored by Early Warning Services. The Federal Trade Commission reported that consumers lost more than $12.5 billion to fraud in 2024, which represents a 25%…

Find Out MoreAugust 2025

Join the FINRA Foundation and explore a variety of tools and resources that will help you better serve your clients and community. This webinar is free for members. Time: Noon ET Presenter: Shay Cook, MS, AFC®️, FFC®️ Financial Readiness Manager FINRA Investor Education Foundation

Find Out More