Student loans have become an important part of the advisor/client relationship. Most clients, and most advisors, however, find student loans confusing and difficult to manage. This post will walk you through the essentials that all advisors need to understand about student loans.

Types of Loans

Student loans fall into one of two buckets: federal and private loans.

Federal loans make-up about 92% of all student loan debt, while private loans account for the other 8%.

Federal loans are issued by the federal government and are regulated by federal law. These loans can be found on the National Student Loan Data System, or NSLDS, at https://nslds.ed.gov/nslds/nslds_SA/.

Private student loans are issued by banks and other lending institutions with repayment terms determined by the lender. These loans can be found on a borrower’s credit report.

Federal loans can be further broken down into four types of loans: Direct; FFEL; Parent Plus, and Perkins. FFEL loans were discontinued in 2010 and Perkins loans were discontinued in 2018, but advisors will see these types of loans on their client’s information.

Repayment Plans

There are two broad categories of repayment plans: Balance-driven plans and Income-driven plans.

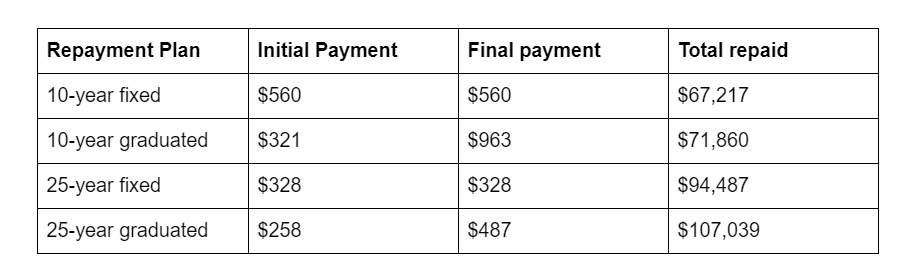

Balance-driven plans include fixed and graduated repayment plans. Clients can have a fixed payment for 10 or 25-years or a graduated plan that starts with a low payment that steps up every two years.

To help understand the various repayment types better, let’s consider a case study of Karen, who is single with no dependents. Karen has $50,000 in student loan debt at 6.2% interest. Her AGI is $40,000.

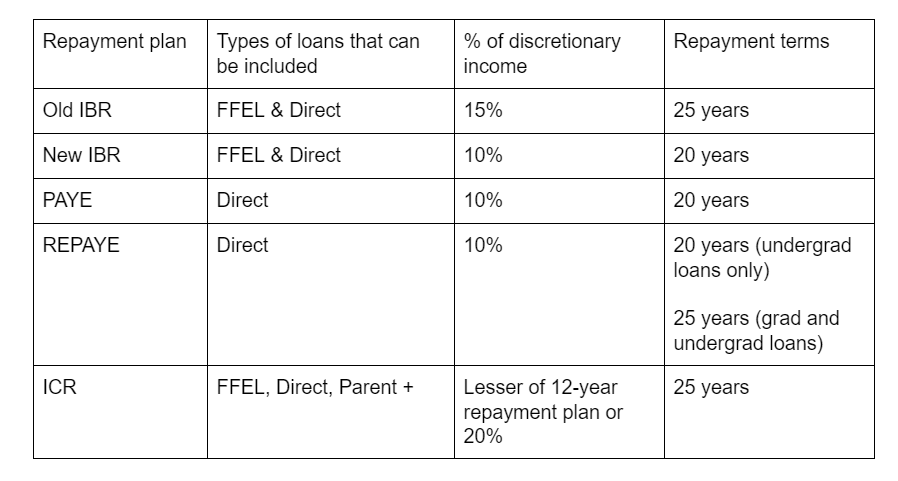

Income-driven plans include Pay As You Earn (PAYE), Income-Based Repayment (IBR), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Under income-driven plans the payment is determined by the client’s AGI, their household size, and their discretionary income.

For most of the plans discretionary income is calculated by taking the client’s AGI and subtracting 150% of the poverty level for their family size. To continue using Karen’s example we will use her AGI or $40,000 and poverty level of $12,490.

The calculation looks like this:

- (AGI – (1.5 x federal poverty rate)) x %

- ($40,000 – (1.5 x $12,490)) x .1)

- ($40,000 – $18,737) x .1)

- $21,263 x .1

- $2,126

Karen’s discretionary income is $2,126 per year.

New IBR, PAYE, and REPAYE all have a payment of 10% of client’s discretionary income. Old IBR is 15%, and ICR is the lesser of a 12-year repayment plan or 20% of discretionary income. Not all loans qualify to use all plans, and the number of years clients will repay is based on the plan chosen and the types of loans included.

On all of these plans any amount remaining after the payment term ends will be forgiven and taxable as income in the year it is forgiven.

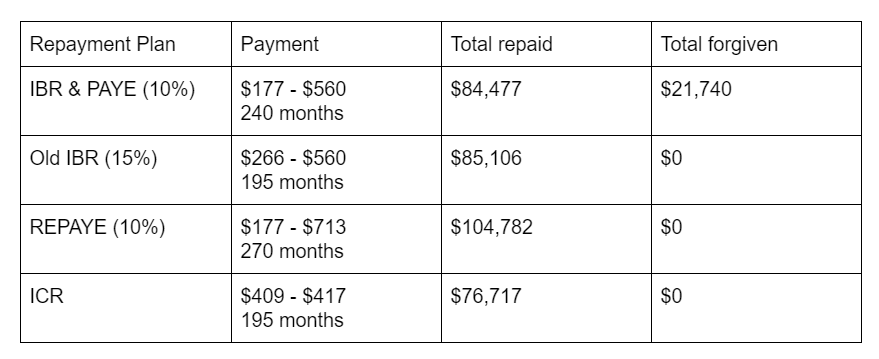

Let’s return to Karen’s scenario to see what the payment would look like under each of these plans:

Refinancing vs Consolidation

As students go through school they can pick up a number of student loans. Many students find themselves with 10-20 different loans with different interest rates. Borrowers can choose to consolidate or refinance their loans to simplify their loans.

Consolidation keeps the loans in the federal system and creates a single Direct Consolidation Loan. This allows older FFEL and Perkins loans to be converted to a Direct loan, opening up other repayment plans and Public Service Loan Forgiveness (see below for more information).

Refinancing takes the loans out of the federal system and puts them into the private lending system. Borrowers who refinance often do so to lower their interest rates. Refinancing removes the options of Income-driven plans and forgiveness, and once refinancing is done it cannot be reversed.

Public Service Loan Forgiveness (PSLF)

PSLF allows employees who work in the public sector to have tax-free forgiveness of their loans after 120 on-time payments. The borrower must have qualifying loans, repayment plan, and employment.

Qualifying loans

Only Direct and Direct Consolidation loans qualify. Other loans, including FFEL and Perkins loans, need to be consolidated into a Direct Consolidation loan before they qualify.

Qualifying repayment plans

Qualifying repayment plans include IBR, PAYE, and REPAYE.

Qualifying employment

The borrower needs to work for the government at any level or a non-profit 501(c)3 organization.

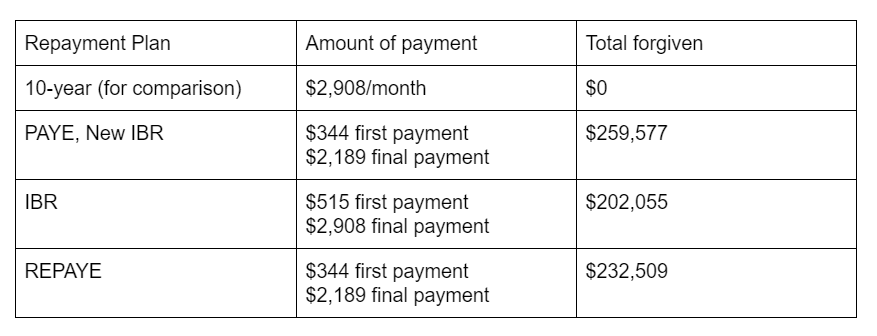

Let’s consider Karen again. Before making any payments on her undergraduate loans Karen goes to medical school, where she picks up another $200,000 in federal debt, for a total of $250,000. She will work as a resident at a non-profit hospital for 5 years making $60,000, with a 3% increase each year, then she will get an attending position making $250,000, with a 3% increase each year. She is still single and has no plans to marry or have children.

Here is how the various repayment plans will look for Karen:

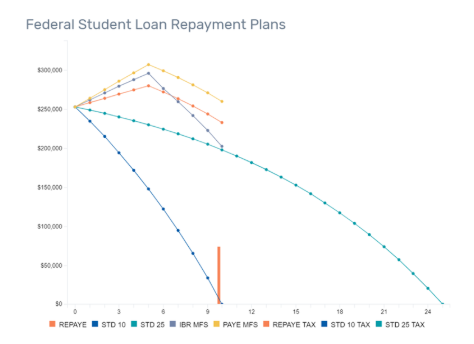

In graph format the payments look like this:

You can see that IBR, PAYE, and REPAYE all have negative amortization for 5 years, then start to decrease after that.

PSLF requires careful planning, as one mistake can eliminate a borrower from being eligible for forgiveness.

Getting Help with Student Loans

Financial advisors should learn all they can about student loans or get help from someone with expertise in student loans.

Here are some resources that may be helpful:

- Student Loan Planning by Ryan Law on Amazon

- LoanBuddy software and education courses

- Heather Jarvis advisor services and education courses

AFCPE will also be launching a new Essentials course, College Finance Essentials, in 2020. Sign up for the Interest List and watch for more information coming soon!

AFCPE Members also have access to a discount for LoanBuddy. Visit your AFCPE Member Dashboard for details or learn more about AFCPE Membership at www.afcpe.org/membership.

Guest Contributor: Ryan Law, CFP®, AFC®

Leave a Reply