My goal as the creator of Money Habitudes® has been to make it easy for people make the connection between our financial behaviors and our emotional messages.

When individuals seem to be facing the same financial challenges repeatedly, it’s a good bet that their behavior is actually fulfilling an important emotional need. By identifying the motivation and emotional payoffs for their seemingly irrational behavior, they can either work through those needs or use strategies to get their needs met in less financially demanding ways. Here are three examples of people who were able to successfully resolve their perpetual financial challenges by identifying their emotional needs from the conversations that resulted when they saw their Money Habitudes® results.

- Fran, a single mom, was continually struggling to make ends meet. She spent way too much money buying her daughters trendy clothes, music lessons and experiences that she believed would be good for them. She discovered that because she felt cheated growing up, she took great pleasure buying everything for her girls so she could live vicariously through them. That insight had not been obvious to Fran and realizing it made it easier for her to judge what did and didn’t have real value for her daughters. She was open to learning how to shop differently and how to find resources that would provide excellent experiences for children without the high price tag. Fran’s spending was more focused, and she got it under control.

- Lynn was nearing retirement and was constantly giving away her money. Her financial planner had warned her not to jeopardize her financial future. Even though she felt it was out of control, she couldn’t stop herself. Through our conversation, she had a new perspective and questions to ask her older brother. He told her that although she was too young to remember before their father died, her mother had felt trapped in an abusive marriage because she had no means of support. Her mother’s demands for academic excellence and her constantly absence working two jobs was to ensure that her daughter could go to college and be self-supporting. That was her way of loving her. Once Lynn realized that she had been loved, she began to gradually learn to love herself and realize she didn’t need to “buy” friendships. She continued to be generous but in a healthier, more financially responsible way.

- In spite of a commitment to his wife to buy a house, James could never seem to save enough money make the down payment successfully. He got pretty close three times, but then gambled the money away each time. Strangely, he was not a gambler at other times. He didn’t understand it himself. Here’s what he realized. He grew up hearing his parents constantly complain about all the “no good rich folks” who lived in luxury and didn’t fix up the rundown rental properties where he and his family lived. Then there were the stories of the “no good rich folks” who swindled his grandparents out of their home. Homeownership had come to signify becoming like those “no good rich folks.” He couldn’t tolerate that image, so he subconsciously sabotaged himself. That insight helped him challenge his old messages about homeowners, and he was successful on his fourth try.

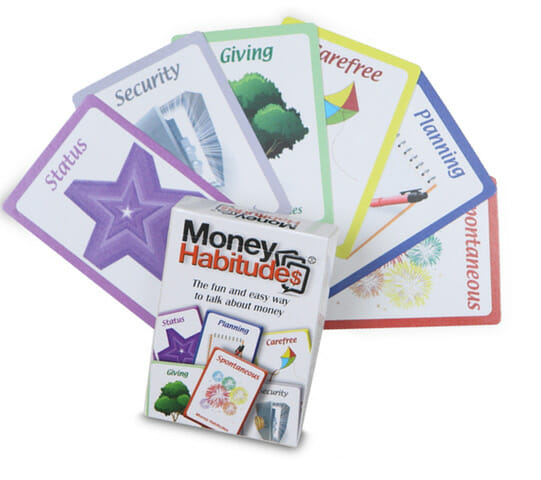

In each of these situations, a logical reason to change behaviors would be overwhelmed by the reinforcing emotional payoffs. To be as effective as possible, financial professionals would be well served to encourage conversations that help clients see the connection between their persistent financial behaviors and their emotional messages. Using financial coaching techniques, developing excellent listening skills and reaching out to work with other professionals who are more skilled in these emotional areas are all ways to help your clients be more successful. And I would be remiss if I didn’t mention that Money Habitudes® cards or the online version are a proven way to start conversations that often lead to these types of insights in a non-judgmental, non-threatening way.

Guest Contributor: Syble Solomon

Syble Solomon is the founder of LifeWise Strategies, a popular speaker on the psychology of money, the creator of Money Habitudes® and an executive coach. AFCPE honored her as the Mary Ellen Edmondson Educator of the Year, and the North Carolina Jump$tart Coalition named her the Outstanding Contributor to the Financial Education of Youth. She has been the keynote speaker for events for universities, international women’s groups, independent financial planners, the NFL and non-profit organizations. Washington Post’s financial columnist Michelle Singletary called Money Habitudes the simple, but extraordinarily insightful game. It is available in the original card version for adults (English and a new Spanish version), teens and young adults (also a new version) and the new online version. Contact her at syble@lifewise.us or www.moneyhabitudes.com.

Leave a Reply