Written By: Stephen Newland, AFC®

About nine months ago, I set off on a journey to lose 70 lbs in a year’s time. I started the journey by first getting educated about how to achieve this and figuring out what tools could help me. Once I had a plan together I was ready to start shedding pounds fast! Just like any goal, I’ve had better weeks than others. For example, we just received our Girl Scout cookies a couple of weeks back so I called that week my mid-point celebration!

About nine months ago, I set off on a journey to lose 70 lbs in a year’s time. I started the journey by first getting educated about how to achieve this and figuring out what tools could help me. Once I had a plan together I was ready to start shedding pounds fast! Just like any goal, I’ve had better weeks than others. For example, we just received our Girl Scout cookies a couple of weeks back so I called that week my mid-point celebration!

It’s not rocket science to know that diet and exercise are the two biggest levers someone can pull to lose weight. Just like earning more money and spending less are two big levers to pull for financial goals. What I didn’t have as part of my equation was automation. Unlike with money, there just aren’t any tools out there (at least that I know of) that can exercise for me or make me eat kale every day.

Luckily, when it comes to money, we have tools available to pass along to our clients to help them automate good financial behaviors. When combined with education it leads to more consistent progress towards their goals. When left to our own discipline we’re more prone to those peaks and valleys that I (and certainly others) have experienced trying to lose weight, save money, pay off debt, etc.

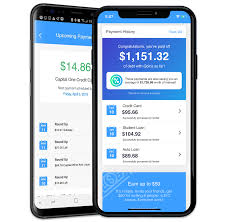

Education + automation + accountability is a winning formula for helping clients achieve their goals quicker and more consistently. A company that caught my eye last year and that I’ve been doing some work with is Qoins. They are on a mission to help people automate discipline when it comes to paying off debt or building an emergency fund. As of the end of 2019, they’ve helped people pay off nearly $10 million in debt.

Qoins has customers link a funding source (debit/checking account) and a debt account that they want to pay off. Using the features below, money is automatically transferred from the debit account to Qoins and then Qoins makes the payment to the creditor on behalf of the customer. The convenience fee deducted for each debt payment is $1.99/month; this is only deducted from the amount saved and never charged directly. So if a customer doesn’t have any activity for a month, they aren’t charged anything. Here are some of the ways users can transfer money from the debit account to pay off debt:

- When I Get Paid

- Each time a deposit of $100 or more comes into a linked account, users tell Qoins how much they want allocated from that deposit automatically to pay debt or build savings with. Users can choose a whole dollar amount or a % of the deposit.

- Round Up’s

- Qoins will round up transactions from a user’s linked account to the nearest dollar and set this “spare change” aside to make extra payments towards debt every month.

- Smart Savings

- If someone is uneasy about sharing their transactions, Smart Savings is an algorithm that will determine how much to contribute each day to the debt payoff account. The algorithm is based on how aggressive the user wants to be with their contributions. Users just need to link a debit account to fund these contributions.

I’ve found that this tool can be helpful for customers at any point in their journey. For someone who is already on track with budgeting, it can be used as a convenience tool that guarantees they make the debt payment instead of spending that money. For someone just getting started, they might need to feel good about rounding up their transactions at first just to start seeing some movement on their debt. The big selling point is locking in discipline vs. relying on discipline that constantly fluctuates from month to month. As we all know, steady discipline leads to achieving goals.

One big aspect about Qoins that attracted me to it was their desire to help customers vs. bombarding them with new debt offers like some other financial tools do. What Qoins is really good at is the automation piece while financial counselors are great at the education & accountability piece. When combined together, it’s a winning combination to help our clients go further faster.

When you find a tool that can help with automating exercise, let me know!