Written By: Catalina Laschon, AFC® Candidate and Jessica Cherubin, AFC® Candidate

Catalina’s Journey

Catalina’s Journey

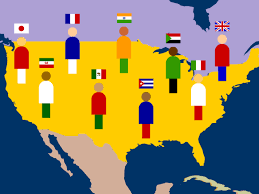

AFCPE and the AFC® accreditation had a remarkable transformative effect on my money mindset and plans. In early 2019, I relocated to the US . I now have more confidence and possibilities. I am inspired to make bold and profound changes to my family’s path toward reaching financial independence.

AFC® Accreditation

Initially, earning the AFC® accreditation was about my own journey. My intent was to understand the US financial lingo and make better financial decisions. The shift in knowledge and confidence was swift. I went from hardly knowing the meaning of credit scores to planning for my financial freedom and its exciting possibilities. I started to envision financial coaching and teaching as an addition to my career further down the line.

DEI Task Force

Shortly after, my journey also became about helping others like me become more knowledgeable. I wanted to help them feel more in charge of their success. Fortunately, I was able to join the AFCPE DEI Task Force. I came up with new ideas of using my newly gained expertise for this goal. I became more aware of the group that I wanted to serve – 1st generation Millennial women who aim to better organize their finances and purchase their first home, as a first step to feeling more grounded and confident that they can reach financial independence.

Pro Bono Work

My pro bono work with this ambitious group cemented my conviction. I can bring my contribution while also learning so much in return. Our similarities help them be their authentic selves. They can be honest about areas they are still trying to adjust to in their new country, including money. For example, buying a house would help them feel more financially safe. It would also boost their confidence that they can be successful here. Our work together is focused on aligning their money planning and spending habits to this goal. We also help them better understand the specificities of personal finances in a new culture.

I started my US path almost 3 years ago, and AFCPE has been a cherished companion for half this time. It’s extraordinary what one can become by keeping an open mind to learning new things. I’m more excited than ever about pursuing my own financial independence and helping others like me in their journey.

Jessica’s Journey

Being the offspring of an immigrant was truly a blessing. As a child, I was immersed in my mothers’ culture; everything I said, saw, and heard was a direct connection to her birth country. My mother was unfamiliar with many of the financial systems of her adopted country (USA). However she always found a way to make ends meet. Yet, she constantly faced numerous roadblocks. These were common to many immigrants when it comes to understanding basic asset building in this newfoundland. Language barriers, new concepts and/or terminology, and trust issues are just a few of the obstacles that stand in the way.

Understanding Personal Finance

There is no doubt in my mind that there are enough resources on this earth for everyone to be financially well-off. Although finances are just a sliver of what we need to survive, we can’t deny its importance in our lives. Make no mistake, money is not everything; but let us agree that without money, there are many things we are unable to do financially. When we are unable to understand finances and how they can help improve our lives for the better, we are unable to realize the joys of purchasing a home, buying a new car, starting a family, going on a vacation, paying for college, funding an emergency, etc. Immigrants are often familiar with how these transactions work in their native countries. However, not every immigrant understands how these transactions translate in their new country.

Financial Counseling

Being a financial counselor has been a blast! Having an immigrant background has helped me understand firsthand some of the troubles an individual or family can face when trying to establish and secure financial wealth. Where there is a lack of familiarity, there is an uneasiness heavily associated with a fear of failure. As a financial counselor my number one goal is to have my clients reap the harvests of success even in its most minute form. When clients are meeting with me for the first time, I assure them that they are in a judgement-free zone. They can trust in me to help them better understand their current financial situation. We can also work together on a future S.M.A.R.T financial plan. My only disclaimer is that I am their guide on this journey. Throughout the process no matter how draining, I’ll be there if they show up. Starting is the first step to realizing success.