Written By: Timothy J. Corriero, Andrew S. Leonard

A house is the largest asset that most families will ever own. It is also the most emotionally-meaningful. Over the past two decades, housing values have increased significantly, even doubling or tripling in cities like New York and San Francisco. These dynamics result in the conventional wisdom that renting is “throwing money away” while buying “builds equity.” This article analyzes those assumptions while addressing the question, “is buying a house a good investment?”

There Are Good Reasons to Buy a House… but Those Reasons Are Not Financial

The arguments for homeownership are convincing enough that both of the authors have purchased a house in the past year. Our reasoning included some combination of the following:

- A home provides stability. We want our children to have a “home base” that they will always remember, think of fondly, and be able to return to

- A home allows us to customize. We want a space that we can use, remodel, and decorate precisely as we choose

- A home provides social benefits. There are proven intangible benefits to owning such an emotionally-meaningful asset. People who own their homes are more likely to be satisfied with their neighborhoods, more likely to get involved in the community, and more likely to participate in political or voluntary activities

- Our significant others want to be homeowners. For some couples, one person feels strongly about one or more of the above reasons. Even if the other does not, this alone can be a powerful motivator

- Renting isn’t an option. The type of home we want, in the area we want to live, simply is not available as a long-term rental.

These reasons are valid and importantly, they are entirely non-financial.

If the Decision Were Purely Financial, You Are Probably Better Off Renting

A properly-constructed ‘Rent versus Buy’ model will typically reveal that renting is the financially-optimal decision. The logic is driven by two factors:

First, the costs of homeownership are significant. These costs, which renters largely avoid, are almost always underestimated. They include:

- Transaction costs. The sale of a house generally involves a commission to realtors that ranges between 2% and 6% of the purchase price. In most regions, the buyer and seller also pay various transfer fees and taxes. These transaction costs create an immediate financial loss that takes time to recoup, making it unwise to purchase a home unless you intend to own it for at least six or seven years.

- Improvements. We mentioned the ability to customize your home as a non-financial argument for buying. The financial downside is that you will likely take advantage of this option, and it is often costly to do so. Homeowners often rationalize these costs by assuming they will be recouped when the house is sold, but because buyers and sellers have different tastes, rarely does a seller fully recover all improvement costs.

- Property taxes and maintenance. While these significant expenses are often the first ones mentioned when discussing the costs of homeownership, we don’t believe that they are a major factor in the ‘Rent versus Buy’ decision, as they are largely implicit or are “baked into” rental prices. That said, because people tend to purchase larger homes than the ones they would have rented, they typically pay more in taxes and maintenance than they would have paid implicitly through rent.

Second, the opportunity costs of homeownership are enormous. The more important, but less obvious, downside of buying a home is the opportunity cost. Money used for a down payment and mortgage (above what would have been spent on rent) could have been invested elsewhere. Any analysis of the financial implications of homeownership therefore must compare the expected return of a house to the expected return of other investments, most notably stocks.

Stocks Have Outperformed Housing Over Any Meaningful Time Period

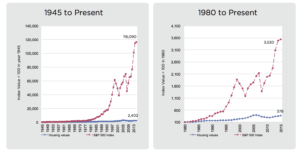

The charts below show the indexed value (starting at $100) of money invested in the S&P 500 versus money invested in U.S. housing over the two different time periods:

The differences are dramatic: in both periods, money invested in stocks had a far greater return. A dollar invested in stocks in 1945 is worth nearly 50 times as much as a dollar invested in housing. How can this be? The compound annual growth rate of housing during this time frame was 4.6 percent, while the growth rate of stocks was 10.6 percent. Compound that difference over 70 years, and the result is pretty staggering.

Academia’s most prominent housing expert reaches the same conclusion: Yale economist (and Nobel Laureate) Robert Shiller measures nationwide home prices going back to the 1890s. His data reveals that from 1890 — just three decades after the Civil War — through 2016, the annual real (meaning, inflation-adjusted) return of home prices was just 0.4 percent. Put another way, home prices have kept pace with inflation, but have provided no meaningful return above that.

As Shiller said in an interview:

“If you look at the history of the housing market, it hasn’t been a good provider of capital gains. It is a provider of housing services… To me, the idea that buying a home is such a great idea is just wrong.”

So Why Do People Think Housing Is a Good Investment?

Conventional wisdom says that buying a house is the wise financial decision while renting is “throwing money away.” Why does this idea persist, despite overwhelming evidence to the contrary? Here are some theories:

- The increase in home price is easy to calculate and remember. We all have loved ones who can recite both the purchase and sale price of a particular house, leaving the impression of substantial gains: “My parents bought their house for $50,000 in 1970 and sold it for $500,000 in 2010!” Of course, you will never hear the comparative return of that capital if invested in stocks over that same time frame, or the housing-related costs (commissions, taxes, maintenance costs, etc.) that were incurred over the years.

- People underestimate the long-term impact of inflation. In the above example, the $50,000 paid in 1970 is the equivalent (after inflation) of $281,000 in 2010. In other words, the majority of the $450,000 increase in value is simply the result of inflation. Because the magnitude of the impact of inflation is not intuitive, it is often underestimated.

- Houses are tangible, stocks are not. That a home has real worth and value is readily apparent to everyone. Stocks, on the other hand, are merely paper representing a claim of ownership in a business. This feels too abstract for some, and downright scary for others.

- Housing prices are less volatile than stocks. Speaking of scary, stock prices are more volatile than housing prices. Stock market declines are more frequent, more severe, and more publicized than those of housing. It is not a coincidence that stocks offer higher returns, as investors must accept more heartache in order to capture those returns. The short-term (relative) stability of housing often convinces people that it is a better investment, without consideration of the long-term trade-off of lost returns.

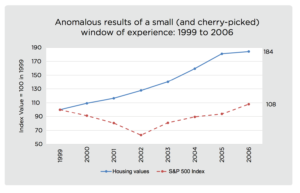

- Your own personal experience is limited (and anomalous). Many of us have direct personal experience with housing values only over the last 15 to 20 years. Housing values have increased significantly over this time frame, but the results are anomalous when compared to any longer period. Below is an intentionally cherry-picked time frame (1999 to 2006) in which housing values increased more than stocks:

Does this time period cover a meaningful portion of your direct personal awareness of housing and stocks? If so, we all have a strong cognitive bias to extrapolate based on our (limited) personal experience, which in this case would be a mistake.

Why Do Stocks Have Higher Returns than Housing?

Books could be written on this topic, but the critical distinction is that houses don’t produce anything, while companies do. Businesses exist to maximize earnings and the growth of those earnings, and stocks capture these efforts. In contrast, the value of a house is based more on supply and demand dynamics than its inherent productivity.

Common Objections and Our Responses

But I use leverage on my house, so the returns are magnified! Thus far in this analysis, we have ignored the fact that most houses are leveraged via a mortgage, which magnifies returns. Of course, stocks could also be leveraged, but most people (wisely) choose not to. An “apples to apples” comparison would have the same result—the levered returns on stocks are much higher. And remember: leverage works both ways, as many people learned in the housing crash of the late 2000s.

But I get a tax deduction on my interest expense! We often hear people talk about the benefit of the tax deduction for mortgage interest expense and property taxes. These are indeed valuable. But the impact of these deductions is simply to reduce the cost of the interest and taxes paid, and does not come close to making up for the difference in returns.

But interest rates are so low! Again, this simply serves to reduce the cost of interest and does not close the gap between housing and stocks. It is also important to understand that when interest rates are low, the prices for assets purchased with leverage, like houses, tend to inflate, which often outweighs any benefits of borrowing at a low rate.

But stocks are overvalued right now, so future returns will be lower! We don’t know if stocks are expensive, or cheap. Empirical evidence suggests that nobody knows. Markets are generally efficient, so stocks are probably worth what they’re trading for today. Housing markets also tend to be efficient (and similarly difficult to predict), so the same logic applies. Attempting to “time” either market is a dangerous game and not worth playing.

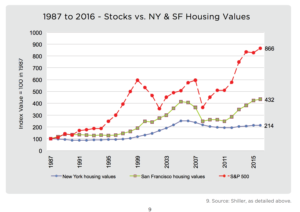

But San Francisco (or New York, or DC…) is different! Admittedly, the housing data above is national, and the graphs would look different if they included only the major metropolitan areas that have exhibited the greatest appreciation. City-specific housing data doesn’t go back as far as national data, but an analysis going back to 1987 makes it clear that stocks have vastly outperformed housing values even in the hottest markets for real estate.

But paying down my mortgage is a form of “forced savings” and prevents me from spending the money elsewhere! For some people, this is a valid point. While it’s more of a behavioral argument than a financial one, that distinction may not matter. The opportunity cost analysis assumes that you would take the money saved (by not buying a house) and invest it in stocks (or a diversified portfolio). If you fear that you might instead be tempted to spend the money elsewhere, having a mortgage that forces you to build equity through monthly payments could create some needed discipline. If that sounds like you, buying a home might be the right financial decision.

Conclusion

There are many good reasons to own your home, and we fully support our clients in doing so. Just be mindful: if you decide to buy a house, you should be doing it because it is life-optimizing, not returns-optimizing. If maximizing our net worth were our only criteria, just about all of us should rent instead.

References

- ‘The Social Benefits and Costs of Homeownership: A Critical Assessment of the Research.’ Joint Center for Housing Studies of Harvard University, October 2001.

Our favorite ‘Rent versus Buy’ calculator is available on the New York Times’ website: http://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

Here we discuss only the financial opportunity cost. Of course, there is also an opportunity cost to your time and energy. Homeownership inevitably involves more work and stress than renting. Your time is valuable; any time spent on housing headaches could be more profitably allocated to your career or more joyfully spent elsewhere.

- While the ideal measure of opportunity cost would be a properly-diversified portfolio consisting of a variety of asset classes (U.S. stocks, international stocks, bonds, etc,), here we use stocks in general (and the S&P 500 index in particular) for simplicity sake, as each investor’s diversified portfolio – and therefore their true opportunity cost – will be different.

- Source: U.S. Home Price and Related data, Robert J. Shiller, Irrational Exuberance, 3rd. ed., Princeton University Press, 2015

- Source: Shiller, as detailed above.

- Source: The Motley Fool (http://www.fool.com/investing/general/2014/05/04/the-uncomfortable-reason-your-home-is-not-a-great.aspx)

- Source: http://www.usinflationcalculator.com/

- Source: Shiller, as detailed above.

Timothy J. Corriero, CFP® is a partner with Geometric Wealth Advisors in San Francisco. He has a B.A. from Colgate University and a J.D. from Harvard Law School.

Andrew S. Leonard, CFP® is a partner with Geometric Wealth Advisors in Washington, D.C. He has a B.A. from Emory University and an M.B.A. from Harvard Business School.