Written By: Shari Evans, AFC®

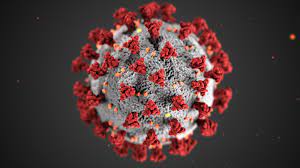

It’s hard to believe that we’ve been navigating the impacts of COVID-19 for more than 12 months. COVID-19 has had a significant impact on personal finances. As we reflect on this impact, it is important for financial professionals to understand some key legislation. These are the CARES Act and the Consolidated Appropriations Act. Many of these provisions helped to keep families financially afloat during the pandemic.

It’s hard to believe that we’ve been navigating the impacts of COVID-19 for more than 12 months. COVID-19 has had a significant impact on personal finances. As we reflect on this impact, it is important for financial professionals to understand some key legislation. These are the CARES Act and the Consolidated Appropriations Act. Many of these provisions helped to keep families financially afloat during the pandemic.

Let’s begin this COVID-19 Financial Year in review in March 2020. The effects of COVID-19 in the US became a reality for many when we experienced a state or county-wide Shelter in Place order. Much like on 9/11, I remember exactly where I was when the Governor announced that after dismissal on Friday, March 13, 2020, students would not return to the classroom the following week. Many working-class families were not prepared to navigate this school closure decision. For some families, this announcement meant additional childcare requirements for school-aged child(ren). For others it meant the tough decision of a working parent caring for their now at home school-aged child(ren).

As families transitioned to stay-at-home options, COVID-19 began precipitating financial uncertainty across varying economic classes and family types. The federal government stepped in to relieve some of the financial devastation experienced within the US economy. President Trump signed the $2 trillion dollar CARES Act into law on March 27, 2020. This was the largest financial rescue package in US history.

To gain an understanding of how we may be able to help our clients navigate their finances in 2021, let’s look at some of the provisions of three key pieces of legislation:

- the CARES Act, March 27, 2020,

- a Presidential Memorandum effective August 8, 2020, and

- the Consolidated Appropriations Act, December 27, 2020

March 27, 2020 – The CARES Act

The Coronavirus Aid, Relief, and Economic Security (CARES) Act is a 335-page bill that was signed into law on March 27, 2020 “to provide emergency assistance and health care response for individuals, families, and businesses affected by the 2020 coronavirus pandemic” https://www.congress.gov/116/bills/hr748/BILLS-116hr748enr.pdf.

March 27, 2020 – July 31, 2020 Unemployment Insurance:

Taxable Unemployment Insurance: Under the CARES Act, a supplemental Federal Pandemic Unemployment Compensation (FPUC) of $600 per week was authorized from March 27, 2020 through week ending July 31, 2020 for those eligible. Since this supplemental unemployment income is taxable, clients may need assistance with developing a tax payment plan.

March 27, 2020- December 31, 2020 Unemployment Benefits:

Taxable Unemployment Benefits Extended: Additionally, the Pandemic Emergency Unemployment Compensation (PEUC) program within the CARES Act, allowed states to extend unemployment benefits up to 13 additional weeks. This change from the previous benefits duration of 26 weeks to 39 weeks was effective through December 31, 2020. As our clients review their finances from 2020, we must help them recall all sources of income.

March 27, 2020 First Economic Impact (Stimulus) Payment:

The CARES Act authorized the First Economic Impact (Stimulus) Payment of $1200 for individuals with an AGI up to $75,000 filing as single or married filing separately based on either the 2018 or 2019 tax return and a payment of $2400 for married filing jointly and an AGI up to $150,000. The Treasury used the filing status of the 2019 or 2018 tax return to determine the payment amount. For filers who did not receive the EIP, they may claim the Recovery Rebate Credit on the Tax Year (TY) 2020 return. According to https://www.irs.gov/newsroom/recovery-rebate-credit, filers who received their full amount of authorized EIP do not need to file for the Recovery Rebate Credit.

March 27, 2020 – December 31, 2020 Retirement Fund Distributions

Taxable Withdrawals. The early withdrawal penalty of 10% is waived for COVID-19 related distributions up to $100,000 retroactive from January 1, 2020 through December 31, 2020. Taxpayers can determine tax liability for distributions by reporting the distribution in equal amounts over 3 years on the annual tax return. Alternatively, they can report the entire amount on the year of the distribution. Of importance here is the difference between penalty-free but not tax-free. Be certain to explain how clients may spread the tax responsibility over the next 3 years.

March 27, 2020 – September 22, 2020 Retirement Fund Loans

Interest Bearing. Individuals may borrow up to $100,000.00 from a workplace retirement plan until September 22, 2020. Borrowers may suspend loan repayments for up to one year. However, a suspended loan is subject to interest during the suspension period.

September 1, 2020 – December 31, 2020 Social Security Tax Deferral:

President Trump issued a Memorandum, “Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster” on August 8, 2020. It allowed for the deferral of withholding employee Social Security tax from September 1, 2020 through December 31, 2020. The Social Security Administration has scheduled repayment of deferred social security tax between January 2021 through April 2021. Of note, service members and federal employees collection period for the deferred tax has been extended through December 31, 2021.

December 27, 2020 – The Consolidated Appropriations Act

The Consolidated Appropriations Act was signed into law December 27, 2020.

December 27, 2020 Second Economic Impact (Stimulus) Payment:

The Second Economic Impact (Stimulus) Payment of $600 for individuals with an AGI up to $75,000 filing as single or married filing separately and up to $1200 for married filing jointly with an AGI up to $150,000. Similarly to the first EIP, filers who did not receive the EIP, may claim the Recovery Rebate Credit on the Tax Year (TY) 2020 return. According to https://www.irs.gov/newsroom/recovery-rebate-credit, filers who received their full amount of authorized EIP do not need to file for the Recovery Rebate Credit.

The provisions mentioned in this article are merely a glimpse of the detailed financial provisions of the CARES and Consolidated Appropriations Act. Hopefully you’ve found it insightful and it sparks your interest in learning more.