Upcoming Events

Upcoming Events

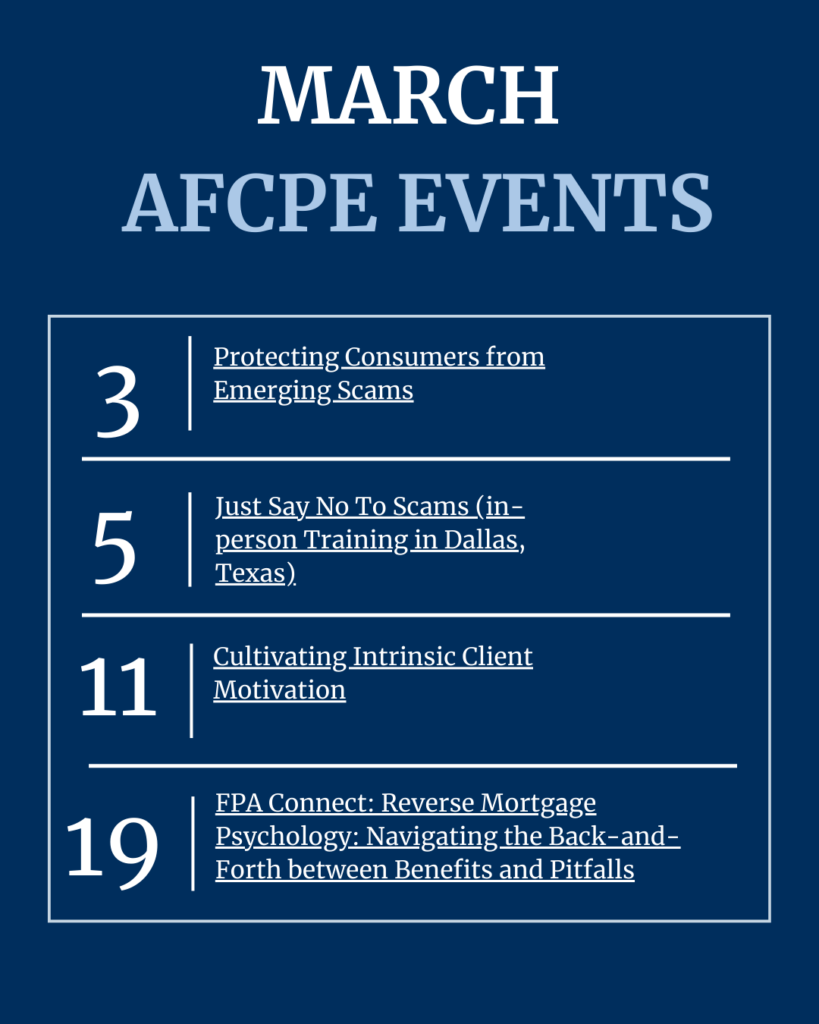

March 2026

To help protect the clients you serve, and in recognition of National Consumer Protection Week, Consumer Action is offering the free "Protecting Consumers from Emerging Scams" webinar, featuring three accomplished speakers who will provide you with knowledge and resources to better serve your community: - Andrew Rayo, chief of staff…

Find Out MoreConsumers lost more than $12.5 billion to fraud in 2024, a 25% increase from the previous year, with identity theft and cyber-enabled scams continuing to rise nationwide. As part of Consumer Action’s decades-long work educating consumers to recognize and avoid fraud, this in-person training equips community educators, counselors, and direct…

Find Out MoreUnderstanding why clients act—or fail to act—is the key to helping them reach their goals. This interactive workshop applies Self-Determination Theory to help you identify where clients sit on the motivation continuum and how to create the specific conditions where their internal drive thrives. Through collaborative breakout groups and self-reflection,…

Find Out MoreAre your senior clients sitting on substantial home equity but struggling with cash flow, or are they reluctant to tap into investments during market downturns? Reverse mortgages can be a powerful financial tool, but they come with complexity, costs, and crucial timing considerations that demand your professional guidance. In this…

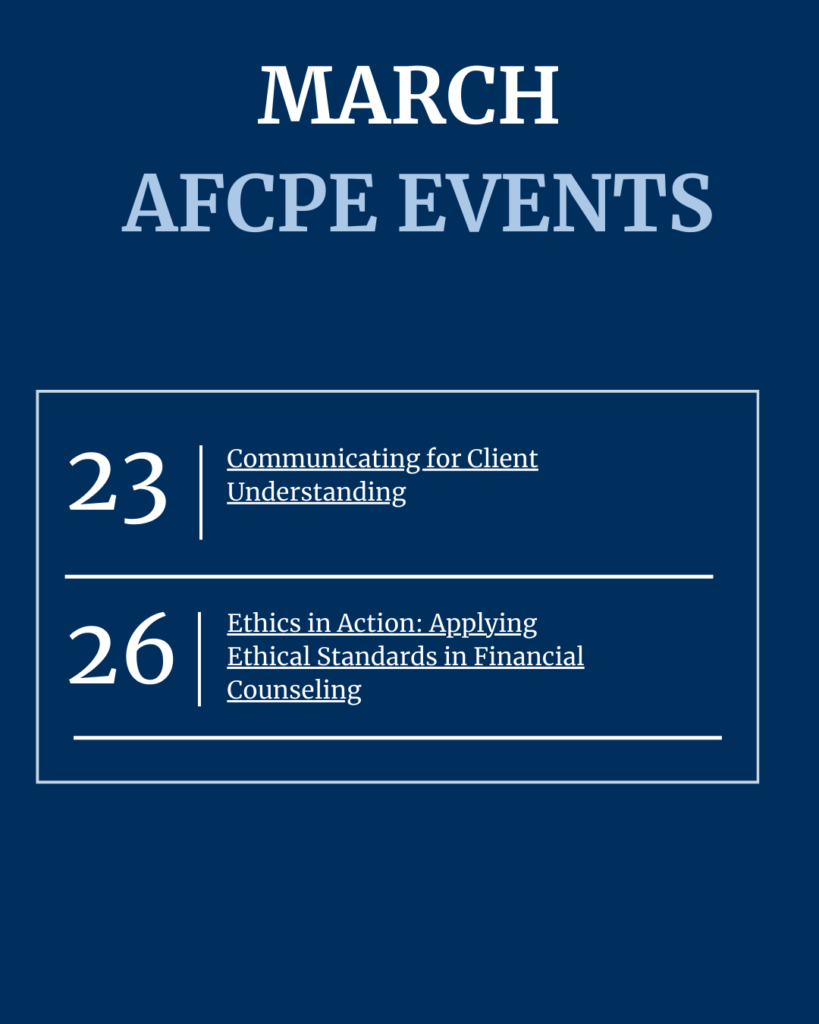

Find Out MoreFew things are more frustrating than explaining a financial concept, only to realize your client is still confused and unable to move forward. This intensive workshop solves the disconnect between expert advice and client comprehension by providing a tactical framework for clear, jargon-free communication. Through interactive breakout sessions and real-world…

Find Out MoreEthical practice is essential to effective financial counseling education. Designed for financial counselors, educators, and military family service providers, this session examines the Military Standards of Ethical Conduct, the AFCPE Code of Ethics, financial disclosure requirements, and federal gifting guidelines. In this 2-hour webinar, Dr. Bruce Ross, AFC®, CFT™, and…

Find Out More