Upcoming Events

Upcoming Events

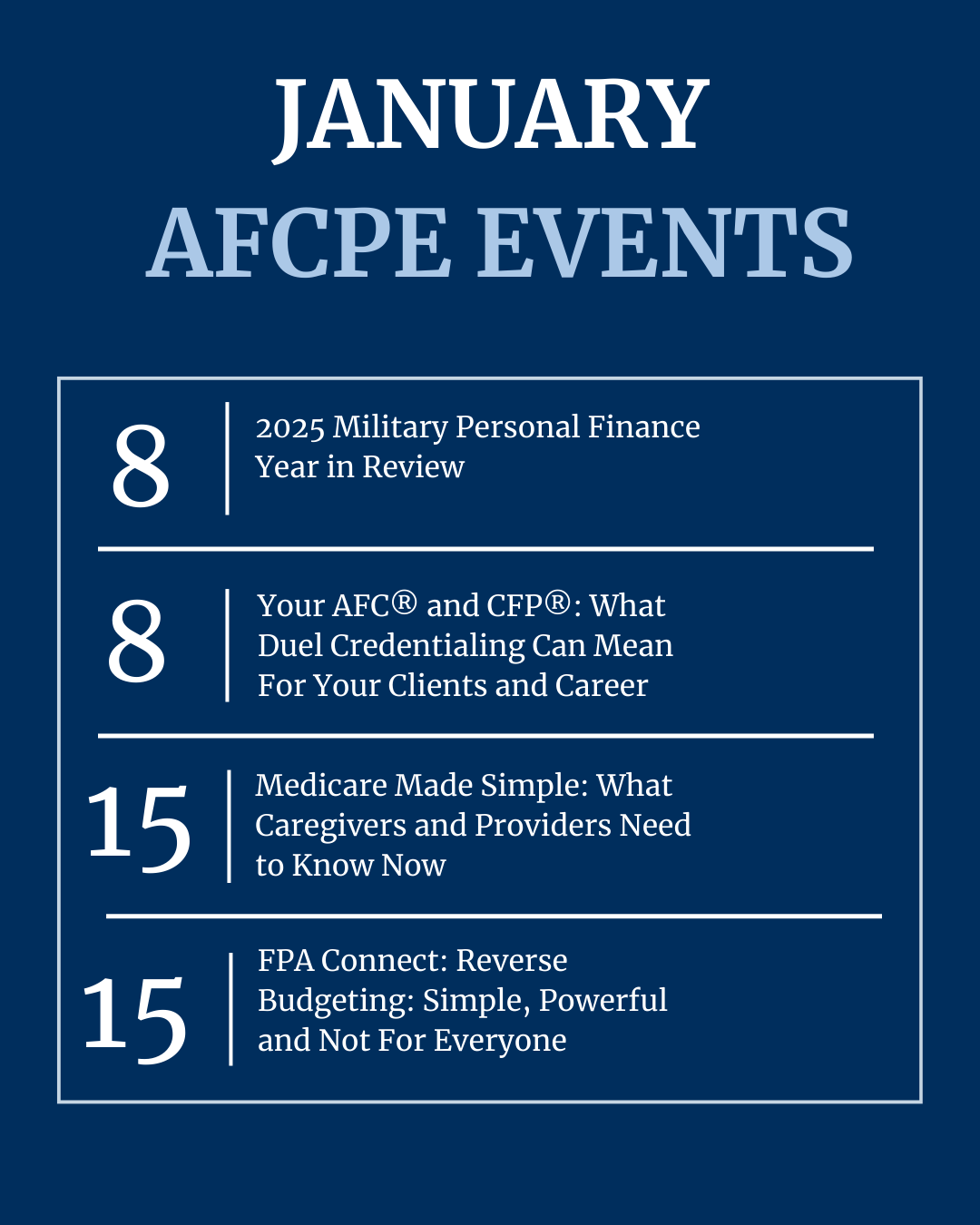

January 2026

You’ve seen it happen in pro bono work. A client schedules an appointment and shows up hopeful—but overwhelmed. They nod along during the session, yet follow-through is limited. Or life gets in the way and momentum stalls after just one meeting. Sometimes, clients don’t show up at all. In pro…

Find Out MoreFebruary 2026

Military life presents unique tax considerations for service members and their families, whether on active duty or in the reserves. This webinar is designed to equip service providers and financial counselors with the knowledge they need to better support the military community. Participants will learn when military pay and benefits…

Find Out MoreCouples can greatly benefit from financial counseling to work through complex financial issues, whether they are preparing for the next step in their relationship or have been together for many years. The Five Money Languages was designed in parallel with Gary Chapman’s Five Love Languages to help couple clients better…

Find Out MoreStudent loan debt isn’t just a young person’s problem. With more than 43 million borrowers across all ages and income levels, the demand for personalized student loan planning is greater than ever. In this session, you’ll learn key points about student loan planning and how adding student loan guidance (either…

Find Out MoreMarch 2026

Ethical practice is essential to effective financial counseling education. Designed for financial counselors, educators, and military family service providers, this session examines the Military Standards of Ethical Conduct, the AFCPE Code of Ethics, financial disclosure requirements, and federal gifting guidelines. In this 2-hour webinar, Dr. Bruce Ross, AFC®, CFT™, and…

Find Out More