The AFCPE® professional membership network is made up of professionals from diverse areas of expertise, uniquely convening professionals across a vast continuum of care. To better serve our clients and positively impact financial wellbeing in our country, we believe it is essential that we work together to build a more integrated and inclusive continuum of care.

Recently, we hosted a webinar to discuss the concept of the continuum of care and its importance for the future of the field. Moderated by Saundra Davis, the session focused on different approaches to a case study through the lens of a financial educator (Dottie Durband, PhD), financial counselor (PJ Gunter, AFC®), financial coach (Vivian Padua, AFC®), FFC™), financial planner (Dylan Ross, AFC®, CFP®), and financial therapist (Kristy Archuleta, PhD, LMFT).

While there are many areas of specialty in the field, like divorce financial analysts or daily money managers and CFP professionals, we are focusing on five broader categories to define the continuum of care: financial education, financial counseling, financial coaching, financial planning, and financial therapy. The continuum of care does not represent a linear approach, but rather identifies specific areas of expertise to build a fluid and integrated service model for more efficient and holistic client service, similar to a medical triage team of experts for healthcare patients.

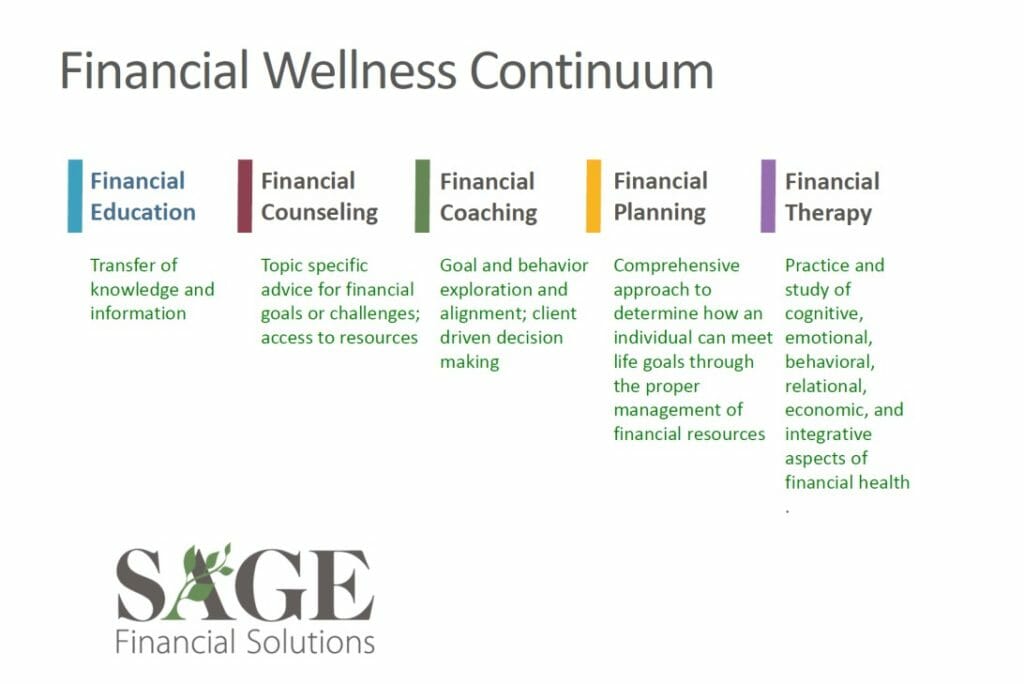

The chart below was developed by Sage Financial Solutions to define the areas of the continuum of care more clearly:

A financial educator directly transfers financial knowledge and information to students and clients with the intention of helping them understand and apply the concepts. Financial educators are focused on the effectiveness of the delivery of information to ensure long-term understanding and financial well-being. Often, educators are working with groups in a classroom or workshop format.

A financial counselor help clients establish healthy financial management habits for long-term financial wellness. Financial counselors, like an AFC®, are trained through a comprehensive life-cycle financial education approach rooted in evidence-based research on the counseling process and theory. They help clients manage credit and debt issues, establish a realistic spending plan, and begin to save for the future. An important distinction between financial counselors and planners is that financial counselors do not provide investment advice or sell products and refer to a financial planner like a CFP® for investment and wealth management.

A financial coach views the client as the expert in their own life, collaborating with them to define their goals and create solutions and an action plan that helps them achieve their goals. A Financial Coach works with clients to identify the underlying values that motivate them toward achieving their goals. Financial coaching focuses on the client’s “why” and is a technique that many financial professionals – financial planners or financial counselors – use to support clients in taking charge of their financial choices and implement effective action plans. AFCPE and Sage Financial Solutions partnered together to develop financial coaching certification programs that hold the highest standards of financial content and coaching skills. Because AFCPE has been recognized for over 30 years as the gold standard for the financial counseling profession, we felt it was important to set rigorous standards for the emerging financial coaching field and bring this technique to our professionals.

A financial planner works with clients to create a plan that focuses on longer-term objectives and wealth management techniques. The planner may have specializations in investments, taxes, retirement, and estate planning. A designation like the CFP® mark represents standards of excellence and ethics and has the backing and oversight of a national organization, the CFP Board. Groups like the Garrett Planning Network offer fee-only financial planning advice to people from all walks of life, without minimum account requirements, sales commissions, or long-term commitments. They embrace their fiduciary duty to put the needs and best interests of their clients first. Likewise, XY Planning Network is also fee-only financial planners and sworn fiduciaries, focused on serving Gen X and Gen Y clients. Both networks are strong supporters of the importance of the continuum of care across the profession and work in close collaboration with AFC® professionals.

A financial therapist helps clients address money issues through evidence-based therapeutic intervention. Financial therapists treat both characteristics of mental health, like anxiety and depression, as well as financial characteristics like risk tolerance, and financial knowledge. This approach allows professionals to help people reach their financial goals by addressing financial challenges, while also dealing with emotional, psychological, behavioral, and relational issues.

The Financial Therapy Association (FTA) is an organization for professionals interested in practice and research in financial therapy and are currently developing a three-tiered certification that can address the complex nature of blended financial and emotional issues while providing practitioners on the continuum the opportunity to elevate and supplement their core practices by adding additional competencies in financial therapy. You can learn more about FTA and financial therapy by joining their Annual Conference, November 13-15th, which is co-locating with the AFCPE Symposium.

At AFCPE, we believe strongly in our vision to create a future where all people, regardless of their income level and background, have access to the highest level of financial professionalism. We can achieve that dream through collaboration and partnerships, like the work we do with Sage Financial Solutions, Financial Planning Association (FPA), Financial Therapy Association (FTA), and many others. It is only through a more inclusive and integrated continuum of care that all consumers will better understand who is most equipped to help them with their unique challenges and needs to ensure lasting financial security.

Join us for more webinars and workshops on building the continuum of care, with further discussion about ethical implications, building that referral network, and ensuring the highest standards of excellence for the profession. One impactful way to do this is by joining us at the AFCPE Annual Symposium in San Diego, where you can meet people from across the field to exchange ideas and build relationships.

Rebecca Wiggins, Executive Director, AFCPE

Want to join the conversation? Interested in participating in future webinars? Have suggestions of areas you want to explore more deeply? Fill out our 2 minute survey.

Leave a Reply